How Do You Know You're Solving a Problem that Matters?

You can't say, "I know it when I see it." That's nonsense. And if you get the problem wrong, you're building on a very weak foundation. (#5)

I’m not shocked when I see a startup that’s jumped to the solution without really understanding the problem, but it’s definitely disappointing. Part of the challenge is that people don’t really know how to even define a problem. We all have problems (some more than others), but it’s difficult to put your finger on a “painful enough problem that warrants building a solution for.”

Here’s the definition that I like to use:

Problem = User + Need + Insight

Let’s break that down:

1. USER:

In this context what we’re looking for is a real person. You don’t need to define every little aspect of this person (I don’t need to know what they ate for breakfast…unless you’re trying to solve breakfast problems), but you do need to have a pretty good picture of who they are.

Too often, startups replace “user” with “big, generic market” such as “Moms” or “Small business.”

“Moms” is not a market. Neither is “small businesses.” Both are simply too generic. People can’t even agree on the definition of a small business (1-10 employees? 11-50 employees? < 500 employees?)

Quick example: All moms do not parent the same

It should be obvious that not all parents parent the same way. But until you really engage with parents, and dig deep, you only have a superficial understanding of your user, and you over-generalize.

In 2010 I invested in a startup called HighScore House. The idea was that parents would provide their kids with a list of chores/tasks, which the kids would do to earn points, and then redeem those points for rewards. Later on I would describe this as, “Bribing your kids to do the shit you want them to do.” (I’m not the best at writing taglines.)

Our target market was primarily moms. As the founders interviewed moms to better understand them, it became readily apparent that some moms were already using a chore system (read: bribing) to motivate their kids or liked the idea, whereas others thought the concept was pure evil. I wouldn’t suggest it was 50-50, but it was in that range; 50% of moms thought motivation through rewards made sense, 50% thought it was an awful approach. And I don’t mean that the latter group was lukewarm or “meh” on the concept, they thought it was the antithesis of good parenting.

At first you might think, “OK, problem invalidated. A lot of moms hate this.” But I felt quite the opposite. I was excited that 50% of moms thought it was a terrible idea, for two reasons: (1) you could narrow the target market down and solve a real pain point for moms that were desperate for a solution (“How can I get Susie to make her fucking bed already?!?!”); and (2) a little opposition isn’t a bad thing, because it tends to make the people who are “for you” even more so. (Note: I realize that last statement runs the risk of drawing parallels to some of our very antagonistic political systems, and that’s not my intent. But pissing off some moms in order to make other moms happy could be a good thing.)

“Moms” is not a market.

A couple other key points about “user”:

You may have multiple user groups. This is often true for marketplaces (buyers & sellers) and enterprise B2B (where the user & buyer aren’t the same person.) If you have multiple user groups you need to understand all of them equally well, because their problems are going to be different.

You should eventually build out real personas: Too few startups have the discipline to do this, but it’s a good exercise. There are lots of good tools for doing this including persona templates and empathy maps.

2. NEED:

Start by focusing on functional needs. A functional need is something people need done. It’s usually the easiest need to identify. You can observe what people are doing, see where there are gaps and fill those gaps.

Jobs to be Done is a useful framework for understanding functional needs. The basic premise is that we hire things to do jobs for us. If you understand the job clearly and the user that wants the job done, you can build the right solution for them. Instead of going into JTBD in detail, here are some good posts about it:

Newsletter #31: Jobs-to-be-done (Ascending World newsletter)

Practical Jobs-to-be-Done (an entire newsletter on JTBD by Mike Boysen)

Jobs to be done (by Brian Morrissey; with a focus on media companies)

Great resource: Intercom is well-known for implementing a rigorous Jobs to be Done framework. And they’ve written a book on JTBD and how they use it

To find a functional need you’re going to:

Conduct secondary research into a market to understand what’s going on (i.e. use Google; dig through CB Insights; follow things happening online.)

Conduct primary research (through customer interviews & observation) to learn more about users/customers (I shared some good resources for doing this in a previous newsletter: Focused Chaos: What does this really mean?)

Create and test prototypes and concepts with users/customers to see what they engage with (i.e. landing pages + ads, clickable prototypes, etc.) (I’ll have to write a separate newsletter post on this.)

Functional needs address WHAT people want, but not WHY, which means we need to dig further after finding a functional need that we think is worth solving.

3. INSIGHT:

This is by far the toughest thing to come up with. An insight is an “aha!” that you learn through doing a lot of customer discovery. Many years ago, I found two “definitions” of insights that I’ve always remembered:

It’s not easy to find insights shared publicly, but occasionally you can find them in a company’s mission or purpose. They reveal what those companies are really about, as opposed to simply “the thing(s) they make or do.”

Method realized that no one ever “showed off” their cleaning products; they were always hidden away. So they made beautifully designed products (that were also good for the environment.) Andrew Warner did a great interview with Method co-founder, Eric Ryan. There are a lot of people that fell in love with Method. Here’s the insight (written from my perspective):

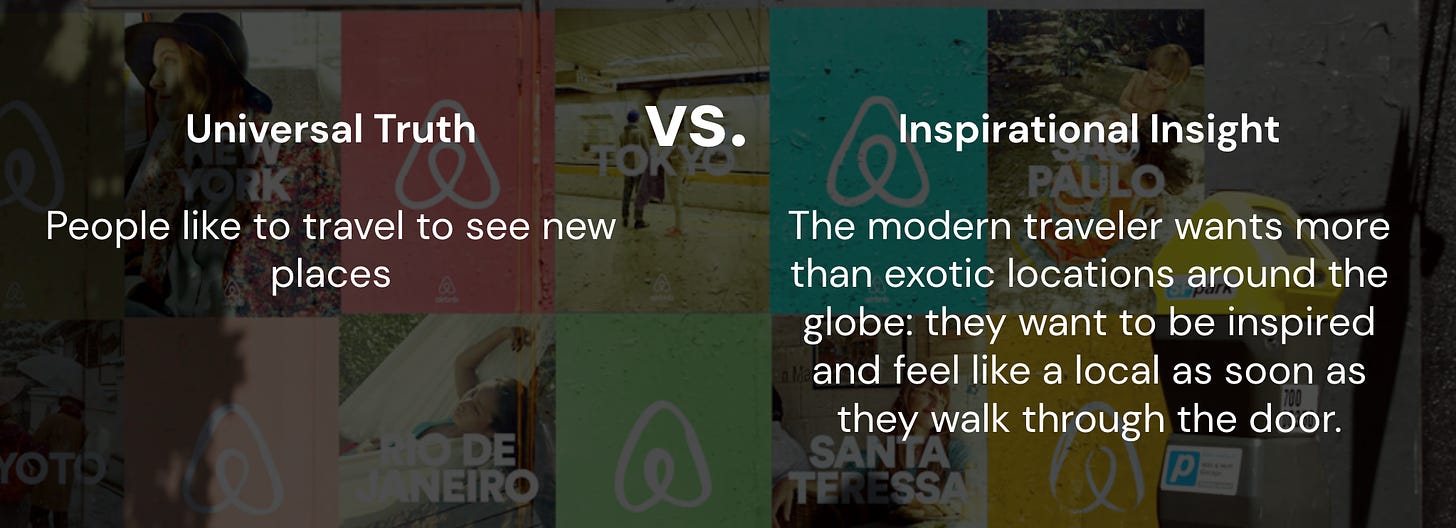

Airbnb started as a way to inexpensively travel (sleeping on people’s couches) and over many years evolved into building a genuine community of travellers. In 2017, Airbnb launched Experiences, which allowed people to book local activities. Even before that, Airbnb had learned that a certain segment of travellers really wanted to “live like a local” and a great deal of the company’s efforts were put into that. IMO, this represents a genuine insight versus what I would describe as a “universal truth” (something we all essentially understand to be true.)

If you can’t find an insight, there’s a decent chance you won’t get real traction, because it means you don’t understand your user enough to target them, speak their language, walk in their shoes, and deliver significant value.

But since insights are really hard to come by, and can be difficult to define, we don’t start there. Instead, we start with DEEPER NEEDS.

So the problem definition formula changes to:

Problem = User + Functional Need + Deeper Need

A deeper need is still meant to understand the ‘why’ of something, but without setting the expectation that you’ve uncovered a once-in-a-lifetime “holy shit” insight.

Deeper Needs are often social or emotional. The human stuff. 😍 😭 😨 🤬

People are not as rational as we might want them to be, or believe them to be. People make decisions (or don’t make decisions) for all kinds of reasons. This is true as consumers (in a B2C context), but also true as employees (in a B2B context.) While they all want functional value, people’s decisions are also governed by how they feel, and how they think they’ll be perceived by others.

Maren Hogan, CEO at Red Branch Media, has a great post on the need for emotion in B2B marketing and sales.

Research shows that injecting some genuine warmth into the process can result in twice as many sales. A CEB study found that 71% of B2B buyers who felt personally valued when making their purchase ended up hitting ‘buy’. So go ahead: show your customers they’re more than just bank accounts.

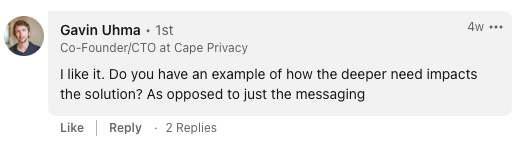

A month ago I wrote a brief post about how to define problems on LinkedIn. Gavin Uhma (who was a co-founder at GoInstant where I used to work), and is now co-founder/CTO at Cape Privacy asked a great question:

In a B2B context, especially in enterprise, we forget that the businesses we’re selling to or working with are not amorphous blobs or “big faceless corporations” but actually groups of people. That’s what a business is: a group of people. And people have feelings. ❤️️

Here was my response to Gavin:

Deeper Need can affect more than messaging. It can affect WHO you sell to, who are supporters and who might block a deal (think about IT Departments wanting their say in the implementation of new enterprise tech; their job is to make sure something fits in, is secure, etc. but they also often “just want to make sure they’re heard” or that they’ve sufficiently “covered their asses” (those are both deeper needs.)

Deeper Need can affect price—think about luxury goods and the “status” people derive from them. Deeper Need can affect go-to-market—think about consumer apps that create FOMO through waitlists.

I’ve heard people say, “No one ever gets fired for hiring ______.” (for example when referencing big consulting firms.) Those firms built a reputation that led to a deeper need of safety, which absolutely impacts the products/services they offer and how they deliver (lots of meetings with senior executives, super fancy decks, etc.)

I’m a big believer in finding and validating specific problems for narrowly-focused markets. You’ve probably heard the phrase, “If you try and solve a problem for everyone, you’ll create a solution for no one.” That’s not to say you can’t grow or jump from one market to another, and build something with mass appeal, but start small and focused. It’s easier to figure out if you have an actual problem worth solving, with the right user, functional need and deeper need.

I like your formula of Problem = Customer + Need + Insight

I want to suggest Kurt Lewin's definition of insight as a useful one for entrepreneurs:

“Insight can always be viewed as a change in the cognitive structure of the situation. It frequently include differentiating and restructuring in the sense of separating certain regions which have been connected and connecting regions that have been connected.”

Kurt Lewin in “Behavior and development as a function of the total situation” (1946)

I blogged about in https://www.skmurphy.com/blog/2012/09/23/kurt-lewin-on-insight/ Insight allows an entrepreneur to look at the same situation an established firms sees but make new connections or break what was first viewed as continuous into distinct subsets (or niches).

I liked your distinction between Insight and Deeper Need.

As an investor, would you require that the founder(s) have discovered a unique insight, or would you be satisfied with a clear understanding of User + Functional Need + Deeper Need (with the hope that, through paying attention to users, the founder(s) would eventually discover a unique insight)?

I'm also curious to hear your thoughts on how acute the Functional Need should be. i.e., are you only interested in opportunities to solve "hair on fire" problems?