Breaking Down an Early Stage Startup Pitch Deck

Send me your pitch deck and I'll provide feedback. (#48)

There’s no perfect structure for a pitch deck. This is particularly true for early stage startups (including pre-seed and seed) because they have less “meat on the bones”—the product might not exist, there may be no traction, etc. At the early stages there are many more assumptions to validate than things you’ve proven, so pitch decks take on a higher-level, “imagine a world where…” storytelling approach.

Early stage startup pitch decks still need to be thorough, detail oriented and answer key questions, but the precise format varies.

Sequoia’s pitch deck template (from 2015) still works. It provides a good structure, but you don’t need to follow it precisely.

Here’s a pitch deck we put together at Highline Beta for a concept called CareClarity.

CareClarity was something we tested in-market (without building an MVP) based on the research we did in eldercare. We put together the deck to socialize the idea with potential co-investors and corporate partners.

Exploring the Eldercare / AgeTech space

I’ve been on a mission for the last ~6+ months to find an opportunity in the eldercare / AgeTech space. My goal is to build and fund at least one relevant in 2024, but to-date I haven’t found the right one.

Others have struggled with this too. Sameer Dhar (who exited his first startup in eldercare) explored 15+ new ideas in the space and came up empty handed. He did a ton of research and customer validation, and was kind enough to share it all with me (and then I shared it through my newsletter).

If you’re looking to build a new startup in eldercare / AgeTech or have something very early stage, feel free to reach out.

The CareClarity deck is high level, missing a few key elements you might expect (I’ll cover the missing slides later), but it’s a good overview of a pre-seed (or earlier!) pitch deck.

Let’s break it down slide by slide.

Slide 1: Mission / Vision / Purpose

This is OK. It’s quite literal and doesn’t use the most powerful language. “Reducing…” isn’t strong, but we didn’t want to say “eliminate” because that’s silly; you can’t eliminate the uncertainty and stress of family caregiving.

It’s important to be clear. This is the first slide investors see, don’t clutter it with a ton of details, and don’t dive into the problem right away. Sell a big vision / purpose with an emotional hook, so people are excited to dig in.

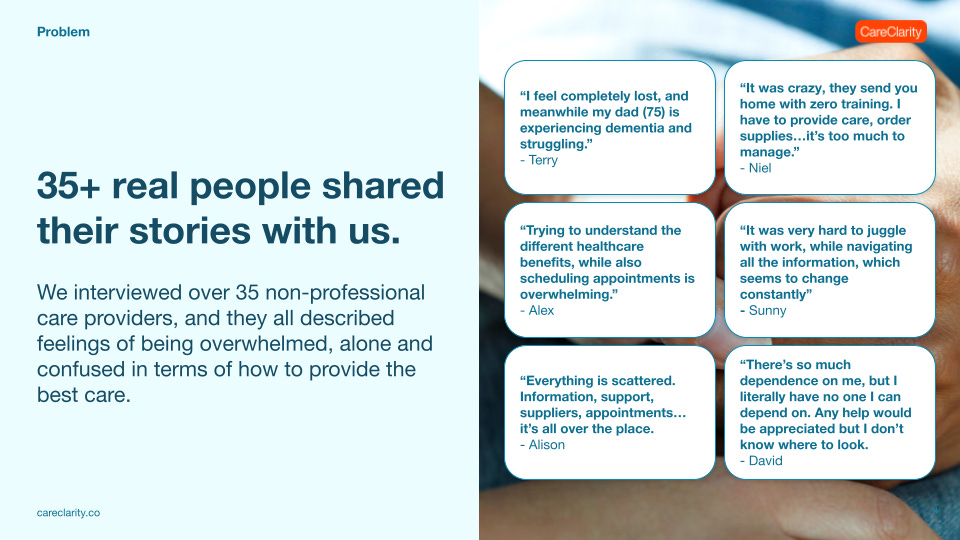

Slide 2: Problem

I like to make the Problem slide as human as possible. My goal is to tug on an investor’s heart strings first, before jumping into the solution, market, etc. That’s why we used the questions on the right-hand side.

Often, the problem slide is obvious, articulating a “universal truth” that everyone understands. “Taking care of an elderly loved one is hard.” No shit. You need to tell me something I don’t know—share an insight that tells me you understand the problem more deeply than anyone else.

I define a problem as User + Need + Insight (or Deeper Need), and this slide does a reasonable job of that, although it doesn’t have a strong insight. Many founders don’t do a good job of articulating a precise user, leaving it open because they’re hedging or don’t really know. That’s something investors will dig into a lot. Who has this problem? Why do they have it more than others? How are they solving the problem today? What do you know about this user group (that others don’t)?

Slide 3: Expanding on the Problem

Most pitch deck templates have 1 slide for the problem, 1 for the solution, etc. but that’s silly. If you need more slides to tell the story properly, go for it.

This slide is intended to reinforce the scale of the problem. We were using this deck to chat with corporate partners (think: insurance carriers, benefits providers, etc.) who will have a deep interest in lost productivity.

Slide 4: We’ve Done Our Homework

Another problem slide?!?! Yup. This one is meant to make it clear that we’ve done our research. Remember, we haven’t built a product yet, so we’re as early as it gets and we need to show evidence that we know what we’re talking about.

The focus is tugging on the heart strings, creating an emotional connection with the audience (be it an investor, corporate partner, etc.) You can create an emotional connection in a variety of ways—not every startup is going after something so personal. But you have to make investors care in the first 2-3 slides otherwise they’ll move on. Investors see thousands of pitch decks a year, and despite the standardized approach, you have to stand out.

❤️ + 🧠 + 💰 = Hearts, Minds, Wallets: the Simple Structure for Great Pitch Decks

Hearts-Minds-Wallets is meant to give you an overarching framework for building a pitch deck.

Hearts: First you connect emotionally

Minds: Then you prove to the audience that you know what you’re doing

Wallets: Finally you demonstrate the potential and have an ask

Read more about this approach and why it works.

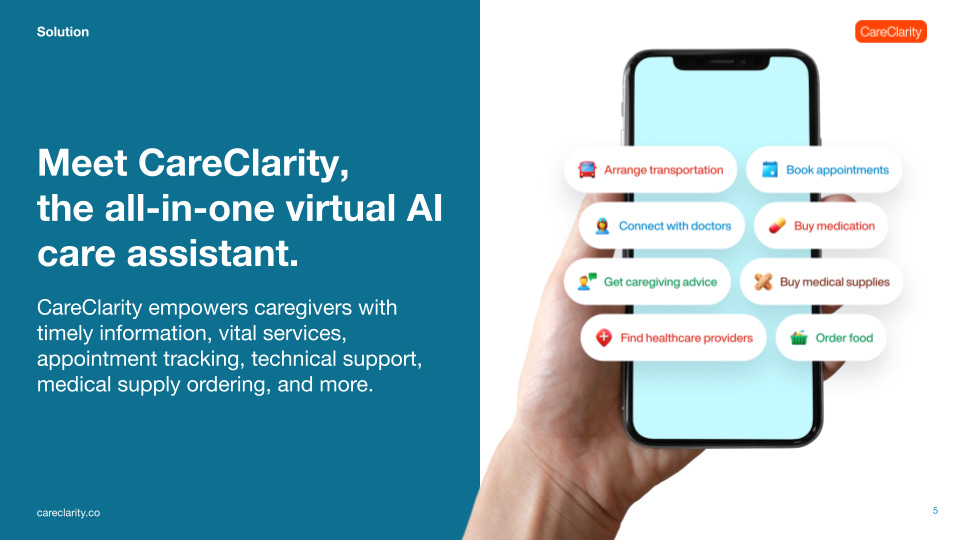

Slide 5: Solution

This is a high-level solution slide, introducing the concept and articulating the value proposition. It’s OK, and really needs the talk track with it.

You have to decide how much information to share in the pitch deck. When sending an introductory deck I tend to go on the lighter side, without every detail. Ultimately I’m trying to get the meeting (with an investor, customer or partner), and using a “teaser deck” to do so. Some founders will use an executive summary for this (which I’m OK with) but I do like getting a bit more context through slides.

The transition from problem to solution should feel like a reveal. This is the moment where investors should say, “Interesting, tell me more…” If they’ve seen a bunch of similar solutions before, they’re going to discredit the whole pitch and assume you don’t really understand the problem in a meaningful way.

Slide 6: The Solution Continued

Again, you don’t need 1 slide for each section of the deck. In this case we added a second “Solution” slide to give a bit more detail on how we envisioned the MVP working.

This also gave us an opportunity to show a use case. Use cases are key! Most pitch decks don’t provide clear “how it works” use cases. I’ve had founders say, “It’s too complicated to explain in a slide” (I call bullshit). I’ve had others say, “The use case is obvious” (no it’s not!) As an investor I need to understand how and when the solution will be used, what the steps are, and how you’re integrating into the customer’s user journey. No solution is used in isolation of what’s happening in a customer’s day, but I find a lot of founders dismiss this. They don’t really understand the customer and their day-to-day lives and haven’t thought deeply enough about how to get usage.

If you have a product in-market then show it. Even just a few key features that you know drive value. You can also link to a product demo or video.

Slide 7: More Solution Information

CareClarity is pre-MVP, so we wanted to setup the context of what we’ll start with and where we’d go next. Investors have to believe the solution will actually create value. You might have articulated the problem effectively but it’s entirely possible the solution misses the mark. Or that the solution seems completely undifferentiated from what’s out there. Tie the features you’re building back to the insights you have from customer discovery.

If you have an MVP, you replace the slides I’ve shared with ones that clearly articulate what the product does, why it works and where you’re going (i.e. product roadmap). So the approach is similar to Slides 4, 5, 6 and 7, but with more detail.

Slide 8: Why Now?

This is a critical slide. Startup success or failure has a lot to do with timing. You might have the right problem and solution, but if the market isn’t ready, or the timing is off for other reasons, you’re going to lose.

We took three “mega trends”—AI, aging-in-place and workplace support—to articulate why we think now is the time for CareClarity to exist. Mega trends by themselves are “universal truths” (things everyone understands) and do not provide an unfair advantage. But the trends may be tailwinds supporting your startup.

You will have to go beyond mega trends. Building a startup from information we can all Google and learn isn’t going to work. I’ll go back to the concept of insights: what do you know that everyone else doesn’t? ← That’s interesting.

Slide 9: Go-to-Market

This is a very simple go-to-market slide. To really nail this you need to dig deeper. What channel(s) do you want to focus on and why? How do you know those are the right channels? What testing have you done to reach your audience?

You should articulate what your user/customer growth will look like over the next couple of years. Feel free to do this on a separate slide. Good investors aren’t looking for precise numbers, but they do want to see some form of business model (ideally bottom-up) with underlying assumptions that they can dig into.

Most startups have a very basic and uninspiring go-to-market slide. Those that get this right stand out big time. The truth is that the best solution doesn’t always win. Distribution wins. Or at least gives you the opportunity to win. Unfortunately, early stage startups focus more on building the product than reaching customers. And very few startups have any advantage in their go-to-market, let alone an actual unfair one.

Slide 10: Competition

Most competition slides are a waste of time. I hate them. 🤣

Founders often do a 4-quadrant layout with their startup in the top right hand corner. The X and Y-axis are usually arbitrary with no sense of whether the variables selected matter to users/customers.

We took a different approach by listing out a few competitors and how CareClarity is positioned against them. Your goal with the competition slide is to:

Make it clear you’ve done your homework and you know there are competitors; and,

Articulate how you’re different.

If you don’t include a competition slide, investors will ask. If you say there’s no competition they’ll move on. There is always competition. Doing nothing is competition. Excel is almost always a competitor. Etc.

Slide 11: Turning Competitors into Partners

CareClarity’s mission is to aggregate “all the things” into one seamless experience. We included this slide after the competition one to suggest that some potential competitors may be partners, and to strengthen the argument for moving away from tons of point solutions into an aggregator play. This is the type of slide that could go in other places (i.e. in the “Solution” section).

Slide 12: Next Steps

Very few pitch decks do a good job of articulating what founders plan on doing next. In our case we weren’t looking to raise capital, so there’s no “Ask” or “Use of Funds” slides, but both of those are similar to this.

We wanted to clearly share next steps and how we’re approaching continued validation.

If you do have an “Ask” and “Use of Funds” slide (or slides), then I would recommend you articulate three things:

How much you’re raising;

How much runway that buys you; and,

How far you’ll be when the money runs out.

Most “Use of Funds” slides have a pie chart or other visual that shows what you’ll spend on. That’s fine, but at the early stage the money is almost always going to the same things (i.e. pay people’s salaries + product dev + marketing). There are other costs, but those three make up the bulk of the budget. We get it, you’ll raise money and spend money. But where will you be when that money runs out? Or put another way: What does that money buy you? This is where the story has to really connect between your go-to-market plan, expected/target traction and spend.

Slide 13: Thank You

I like ending where I began, with the mission / vision / purpose. Ending on the “Ask” slide is boring. Have one more slide that lifts people up emotionally and reconnects with them on a human level. This does an OK job, but honestly it’s not great.

The Missing Slides

The CareClarity deck is missing a few slides that you would expect in an early stage startup pitch deck, including:

Market Size

Team

Traction

Business Model

1. Market Size

I’m not sure I’ve ever seen a great “Market Size” slide. They usually show giant numbers representing some made up TAM (Total Addressable Market), SAM (Serviceable Addressable Market) and/or SOM (Serviceable Obtainable Market). Blech. 🤮 If you take a 50,000 foot view of a market it’ll look gigantic. But the numbers are always bullshit.

Startups don’t need to target “big markets” right away. Don’t tell me you’re going after the B2B Marketing SaaS market (what the hell does that even mean?), tell me you’re going after a very specific, niche market that you can dominate.

Don’t tell me how you’ll get 1,000,000 customers, tell me how you’ll get 10. And then keep them happy. And then get 10 more. And then figure out a repeatable, scalable way of getting the next 100. And so on. Pre-seed and seed stage startups are looking for problem-solution fit, not product-market fit. That means proving you’re solving an actual problem in a way that creates value for early adopters. I roll my eyes when a startup that’s just launched an MVP is already declaring product-market fit or telling me they’ll get there with a handful of customers. Wrong.

In the CareClarity deck we touched on market size in Slide 3 when we talked about the scope of the caregiving problem in the U.S. What we didn’t do is nail a target user persona or narrow down beyond “family caregivers.”

2. Team

You absolutely need a team slide. We didn’t include one because there’s no founder for CareClarity. This was an internal project we were exploring through our venture studio. Anyone we share this deck with knows about Highline Beta already.

Great team slides are very rare. Usually it’s a bunch of people’s faces with logos of companies they’ve worked for or schools they’ve attended. I’ll be completely honest: I don’t care that you worked at Meta and went to Harvard, unless you’re building a social app for college kids.

I know some investors have very strong opinions on where the team slide should go. They’ll say, “If it’s not at the beginning you’re hiding the team,” which I think is exaggerated. It might not fit into the flow at the beginning (or it might).

The best team slide articulates why you’re the team to take on this opportunity. What makes you special?

Unfortunately most startup teams don’t have something that makes them the perfect people for the job, which is why most team slides are meh.

And “what makes you special” cannot be your advisory network or board of directors. Neither of those groups will be building your startup. They’ll be advising and guiding (which is awesome) but you’re responsible for winning, not them.

3. Traction

Every pitch deck should have a traction slide, even if you’re pre-MVP. In CareClarity’s case, Slide 4 is our weak attempt at “traction”—we talked to a bunch of people and heard their pain. If you’re pitching an investor that won’t be good enough.

If you’re pre-MVP, you still need to show a version of traction. For B2B startups it could be LOIs (letters of intent) from buyers. For B2C startups it could be conversion data from a landing page to a waitlist. Even testimonials help. There are lots of ways to get at least some evidence (qualitative and quantitative) that your solution is going to be valuable to users/customers before building it.

If you’ve launched your MVP, you need data. It might be very little data, but you’ll have to show something. With an MVP you need to demonstrate Stickiness—that people are using the tool at a level of frequency that tells you they’re getting value. The further you are with the MVP, the more data you’ll need to show.

4. Business Model

Slide 9 in the CareClarity deck says that subscriptions will be $10-$15/month. That’s not enough business model information for an investor pitch.

Almost every startup pitches a 3-5 year plan. None of these plans work. That’s not to say the plans are complete nonsense, but they’re designed to show hockey stick growth around the third year and how the startup will be worth $50M-$100M in 5 years. It’s the same in every single pitch. 😆

If you get asked for deep dive financial statements at the pre-seed or seed level, you probably should walk away. Those investors are poking at things that are inherently vague and uncertain because of the stage you’re at.

But you should be able to articulate the business model, how it scales, what you need to achieve that scale and most importantly, the underlying assumptions. I never look at a business model and think, “I’m going to hold you the founder accountable to it.” Instead I want to understand why they think they can charge $15/month, or why they think churn will only be 0.5% per month, or why they think they can get 5,000,000 customers in the first year when conversion on the website is only expected to be 2%. Good investors are looking to see if you understand the interconnected, moving parts of the business, not hold you to your absurdly optimistic business model.

Design Matters, But…

Ugly decks get less attention than nice looking decks. So we put a good chunk of effort into making things look good. Good design forces you to be precise and clear with the content, instead of taking the “shoving more stuff onto slides” approach.

Having said that, when you look back at decks from successful startups, they’re often far from beautiful. A great opportunity, with an awesome team, at the right time, is going to win over a well-designed deck. (Still, make the decks look nice!)

Here are some great pitch deck examples:

Mint.com’s pre-launch pitch deck: I don’t like the “Exit” slide, but I do like the “Risks & Precautions” one because it shows you how they’re thinking about potential challenges.

ooomf’s pitch deck (raised $2M with it): Interestingly, ooomf later pivoted and became Unsplash (which is a good reminder that raising capital does not equal winning).

You can learn a lot from how others pitch. But tell your story, in your way. The ingredients are basically the same across all pitch decks and there’s a benefit to not doing something completely radical in the hopes of being memorable. Investors are creatures of habit, scanning and reviewing tons of pitches per year. They’re used to a certain flow. But it’s still your story and your vision. Own it.

Are you an early stage (pre-seed / seed) startup? Do you want feedback on your pitch deck?

I’m going to review the first 10 pitch decks that founders email me. It’s fun, I enjoy doing it, and if I can help people, fantastic!

Subscribe to the newsletter. You’ll then receive a welcome email.

Respond to the welcome email with your pitch deck (link or attachment).

Give me ~5 days and I’ll send feedback.

Note: I’m not looking to invest in any startups that pitch me. But I will give you honest, detailed feedback that hopefully helps you improve how you tell your story and raise money.

Hi Ben,

My last couple of businesses were in the SeniorCare space. I spent close 10 years building a non-traditional in-home care business. I also successfully turned around a struggling memory care facility. I sold both, to different buyers, during the height of Covid. I did well on the exits and and have been considering a tech solution for the space. I think I have a unique perspective and am available to visit if you are so inclined.